The convenience offered by the lender was unmatched back when the brand first launched, and it wasn’t long before Rocket Mortgage was making a real name for itself and challenging even the best banks for mortgage lending.ĭan Gilbert’s idea of putting the mortgage process online may have seemed revolutionary back in 1998, but Rocket Mortgage’s fast rise in the market proved that his idea was the way of the future. Unsurprisingly, borrowers were quick to pivot from a traditional brick-and-mortar mortgage process to Rocket Mortgage’s digital one. As the mortgage industry shifted toward digital-focused home loans, Rocket Mortgage’s online lending processes quickly gained traction with borrowers.

While many borrowers today almost expect the majority of the mortgage process to be digital, the technology to make it happen didn’t exist before Rocket Mortgage. Unlike the traditional mortgage process, Rocket Mortgage promised a 100 percent digital mortgage experience, with borrowers able to complete all parts of the mortgage process from the comfort of their own home. In fact, Rocket Mortgage was a pioneer in the digital mortgage industry, paving the way for other loan companies to follow suit. Today, many customers expect to be able to handle their mortgage and other finances completely online, but that wasn’t always the case. Rocket Mortgage was the first lender to provide a completely digital and online mortgage experience from start to finish. And if they still wanted a more traditional experience, they could choose to get their mortgage through Quicken Loans instead. Using Rocket Mortgage, borrowers would be able to go through the entire mortgage process-from preapproval to closing-without stepping foot in a brick-and-mortar location or seeing a loan officer in person. Rocket Mortgage was created in 2015 as a subsidiary of Quicken Loans-one that would handle 100 percent of the company’s digital mortgage business. Quicken Loans launched the Rocket Mortgage brand in 2015 to manage its digital mortgage business.Īs Quicken Loans’ digital mortgage business continued to grow, the company decided it needed to put more of a focus on that aspect of the company, which led to the introduction of Rocket Mortgage. By 2010, Quicken Loans marked a major milestone by closing its 1 millionth loan.Ģ.

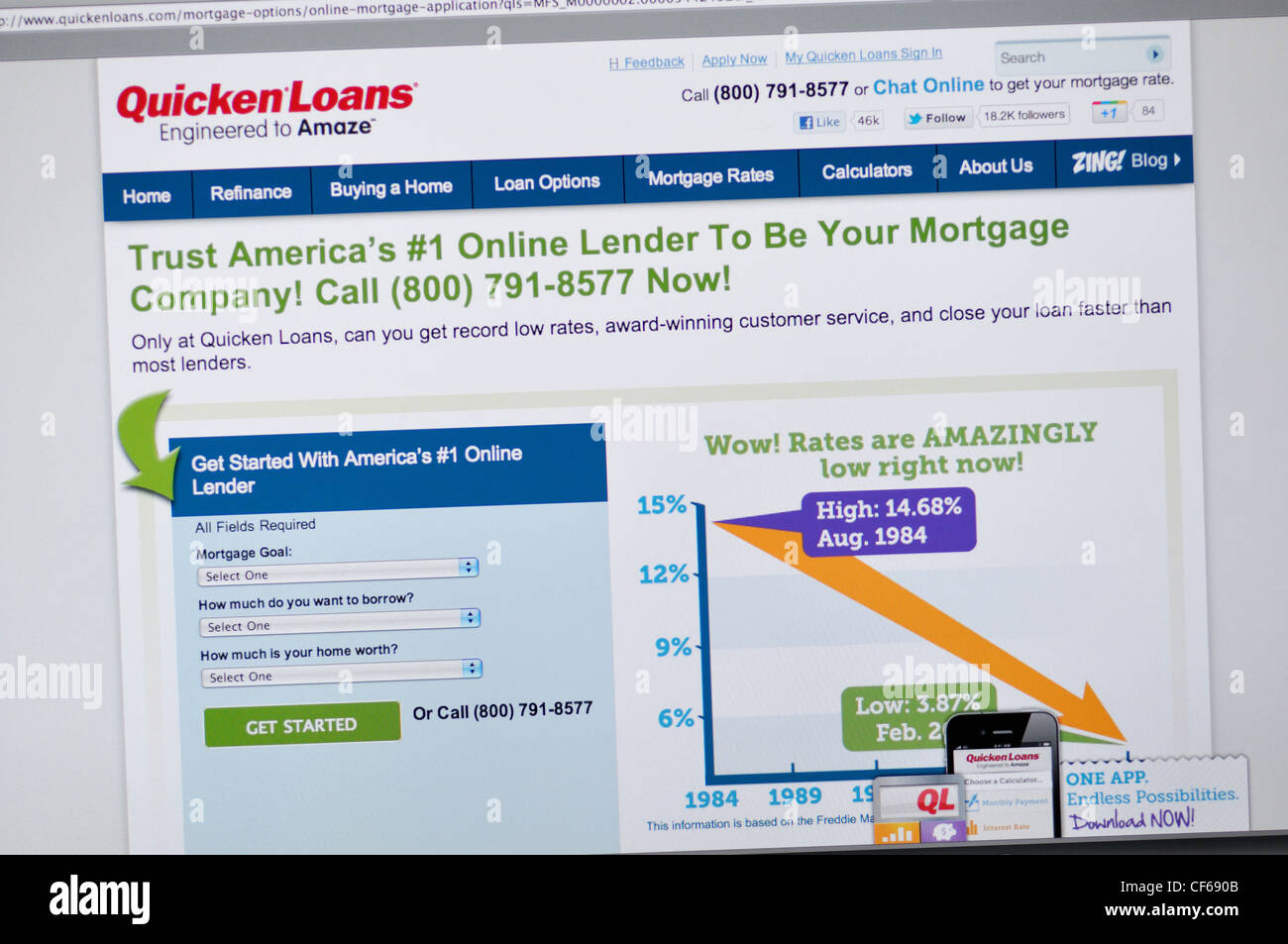

Shortly thereafter, was launched to help provide borrowers with online tools such as a payment calculator and online mortgage application. This acquisition was short-lived, though, as Gilbert and some private investors purchased Quicken Loans back from Intuit in 2003, retaining the branding and marketing of the company. A year later, in December 1999, the company was purchased by Intuit and was rebranded as Quicken Loans.

But Rock Financial began working on achieving this goal, and launched in 1999-this was the beginning of the company’s digital mortgage business, designed to offer a simple and easy process for customers. Since the internet was still gaining traction with the general population, this goal likely seemed like a stretch at the time. In 1998, Gilbert emailed his staff explaining that his eventual goal was to put the entire mortgage process online. But this “Mortgage in a Box” was just the first step toward a truly simplified mortgage process. Gilbert’s goal was to simplify the mortgage process for customers-before the internet was widely used, this meant mailing mortgage documents to customers so they could sign them at home. Rock Financial, a mortgage broker, was founded in 1985 by Dan Gilbert and became a mortgage lender in 1988. However, the history of the company can get a little confusing. While both Rocket Mortgage and Quicken Loans are recognizable names in the mortgage industry, many people don’t realize that they are actually one and the same.

0 kommentar(er)

0 kommentar(er)